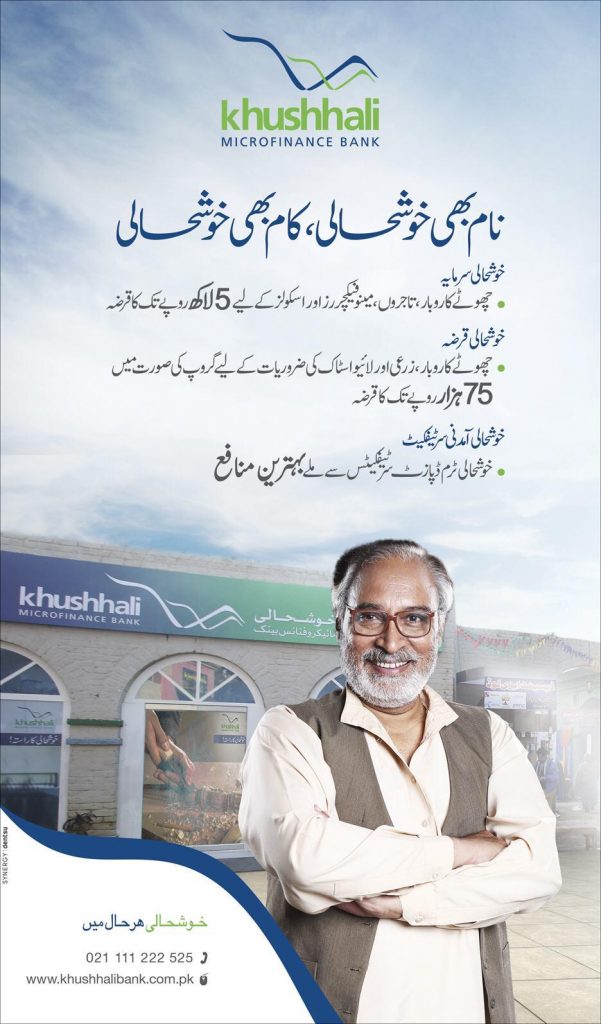

Khushhali Bank Limited

Khushhali Bank Limited products included Loan in three categories Like GROUP LOAN consists on Khushhali Qarza and Khushhali Asaan Qarza. INDIVIDUAL LOAN Consists on Sarsabz Karobar, Khushhali Cash Sahulat, Khushhali School Loan , Khushhali Qarza Plus, Khushhali Livestock Loan, khushhali bank student loan & Shandar Bachat Scheme.

You can get khushhali bank loan information from this page, For khushhali bank salary loan,khushhali bank car loan and khushhali bank livestock loan you can dial khushhali bank contact number khushhali bank branches in karachi from Mobile phone.

Loan Eligibility Criteria:

Khushhali Qarza:

Age: 20 – 63 years

Income: Less than or equal to Rs. 500,000

Permanent resident of the locality for 2 years

NADRA CNIC/ SNIC holder

2 years experience

Amount of Loan: PKR 20,000 to PKR 50,000

Khushhali Asaan Qarza:

Age: 20– 63 years

Income: Less than or equal to Rs. 500,000

Permanent resident of the locality for 2 years

NADRA CNIC/ SNIC holder

2 years experience

Amount of Loan: PKR 15,000 to PKR 75,000

Sarsabz Karobar (Value Chain Financing)

Sarsabz Karobar caters to the financing needs of small certified growers of Public or Private Agro based organizations, primary /secondary milk suppliers, artisans, craftsmen, entrepreneurs & small traders involved either in supply/ manufacturing of raw material or finished goods, end users of technology & energy equipments.

Loan Eligibility Criteria

Age: 20 – 63 Years

Proposed Value Chain Partner’s reference

Household annual income less than or equal to Rs. 500,000/- or less

Business experience of 2 years

NADRA CNIC/ SNIC holder

Not defaulter of KMBL or other banks

Khushhali Cash Sahulat

Khushhali Cash Sahulat is an ‘Individual Loan’ collateralized through a range of acceptable securities. The loan may be utilized to expand micro-enterprises/ small businesses and offers free embedded credit life insurance.

Loan Eligibility Criteria

Age: 20 – 63 Years

Household annual income up to 500,000

Business experience of minimum of 2 Years

NADRA CNIC/ SNIC holder

Not defaulter of KMBL or other banks

Khushhali School Loan

To offer private school owners involved in providing low cost education to improve school infrastructure/ acquisition of quality enhancing products and service

Loan Eligibility Criteria

Age: 20– 63 Years

School must be in operations from the last 2 years

Minimum 100 students enrollment

Minimum fee Rs.350/- per month per student

NADRA CNIC/ SNIC holder

Khushhali Qarza Plus

Loan Eligibility Criteria

Age: 20– 63 years

Minimum KMBL relationship of 3 cycles (not less than 24 months)

Previous loan of KMBL to be either fully settled or only accrued mark-up to be paid till date

Permanent resident of the locality for 2 years

NADRA CNIC/ SNIC/ NICOP holder

2 years experience

Khushhali Livestock Loan

Product Purpose

Insured perils Purchase of new animals (cows, buffaloes and bulls) for fattening, breeding and milking

Non Insured perils: goats, sheep, poultry and fisheries (non-insured)

Free animal’s life Insurance in case of death/ theft (applicable for insured perils only)

Loan Eligibility Criteria

Age: 20– 63 years

Age of animal to be purchase must be between 9 months and 7 years

Applicant willingness to tag the animal for insurance cover

Minimum 2 year experience of livestock keeping/ handling

Having at least 1 animal

NADRA CNIC/ SNIC/ NICOP holder

Shandar Bachat Scheme

Product Purpose

To offer a platform that facilitates small savings with an additional offer of loan facility for enterprises and livestock sector.

Loan Eligibility Criteria

Age: 20– 63 Years

Positive & Adequate Cash-flow (financial toolkit)

Annual income of the applicant as per prudential regulations

Residing in the area from the last 2 years

Business experience of minimum of 1 year

NADRA CNIC/ SNIC/ NICOP holder

Not defaulter of KMBL & other institutions

Khushhali Sarmaya (Micro Enterprise Lending)

Product Purpose

Khushhali Sarmaya is an individual loan microenterprise loan available for the micro-entrepreneurs and small farmers/livestock owners. Including purchase of raw material, finished goods, stocks inventory to enhance production of goods and services

Credit for operating assets to generate income for small business.

Loan Eligibility Criteria

Age: 22– 60 years

Applicant must be micro-entrepreneurs who are either self-employed or employ few individuals maximum 10 (excluding seasonal labors)

Minimum business experience of 2 years

NADRA CNIC/ SNIC holder

Must have good credit history and not availed multiple loans

Khushhali Bank Limited Online Apply